The motto of the game industry for last year was “Survive until 2025.” And in a certain aspect, that was not just an illusion.

As the industry walked until 2024, the market researcher DDM saw positive signs. And with a quarter of 2025 in the books, it certainly seems that things are in a trend in the right direction when it comes to games offers: investments or mergers and acquisitions.

Q1 2025 Not only Marks the Second Consecutive Quarter of Growth, But It is the Largest Quarter Since Q4 2023, With Combined Games Investments and M & As Totaling $ 7.8 Billion Across 245 Transactions ( +29% In Value And +1% In Volume Comparated And +1% In Volume Compart And +1% In Volume +Acrose fosde fosde fosde fosed and +acrose fossed and +acrose fosde fosed and +acrosis and +acrose fount and +acrossed fosud and +acreado and + +fossed and +acreado acrosted.

General description of the 2025 quarter

Investments Q1 2025 saw a significant increase in value, totaling $ 4.4 billion in 190 investments (+370% in value and -8% in volume compared to the $ 945.9 million of the fourth quarter in 207 investments) that record 4.7 times in the growth of the value in the growth of value in the growth of value.

Q1 2025 m & a saw a considerable decrease in the value, for a total of $ 3.3 billion in 55 transactions (-34% in value and +53% in volume compared to the $ 5.1 billion of the fourth quarter in 36 transactions), despite having the largest actually 22. In 44 m & a not revealed (80% of the total volume and 13% above the quarterly average or 67%).

And the quarter saw an important increase in new fund ads, for a total of $ 21.8 billion in 43 funds ( +122% in value and +13% in volume compared to the $ 9.8 billion of the fourth quarter in 38 funds), marking the largest Qu2 202; This 2.2 times the growth of the QOQ value was promoted by five funds that collectively raised more than $ 14.3 Bilio (65% of the capital collected).

Mitchell Reavis, director of DDM Games Investment Review, said in a statement: “There is no doubt that ‘surviving up to 2025’ became a defining mantra for the games industry during recent turbulent years. While DDM anticipates current layoffs, strategic strategies and non -commercial commercial investment offers.

Summary of investments

Q1 2025 Investments TotalD $ 4.4 Billion Across 190 Investments (+370% in Value and -8% in Volume Compart To Q4s $ 945.9 Million Across 207 Investments) Achieving A 4.7 Times In Value Growth Qoq and The Billost Value 2022 OR $ 2022 OR $ 2022 OR $ 2022 OR $ 2022 OR $ 2022 O $ 2022 O $ 2022 O $ 2022 O $ 2022 O $ 2022 OR $ 2022 O $ 2022 O $ 422 OR $ 422 O $ 422 O $ HEST $ HEST AND BILLHIONSTEEST $ / $ 42222 OR $ HEST. This achievement can be attributed to the investment of $ 3.0 billion of Sterling Select Infinite reality (67% of the quarter of the quarter).

The firm said that the investments of Game developers Q1 2025 totaled $ 4.0 billion in 103 investments (+457% in value and -27% in volume compared to the $ 720.0 million of the fourth quarter in 141 investments).

Artificial intelligence and blockchain continue to receive investors’ enthusiasm, since artificial intelligence investments of the playground totaled $ 3.1 billion in 32 investments ( +2.288% in value and +14% in volume -cross $ 130.8’s $ 130.8 $ 130.8. Investments of $ 372.2.2.2 of 28 investments ( +74% in the value and value of 54% in the value of 540.8.

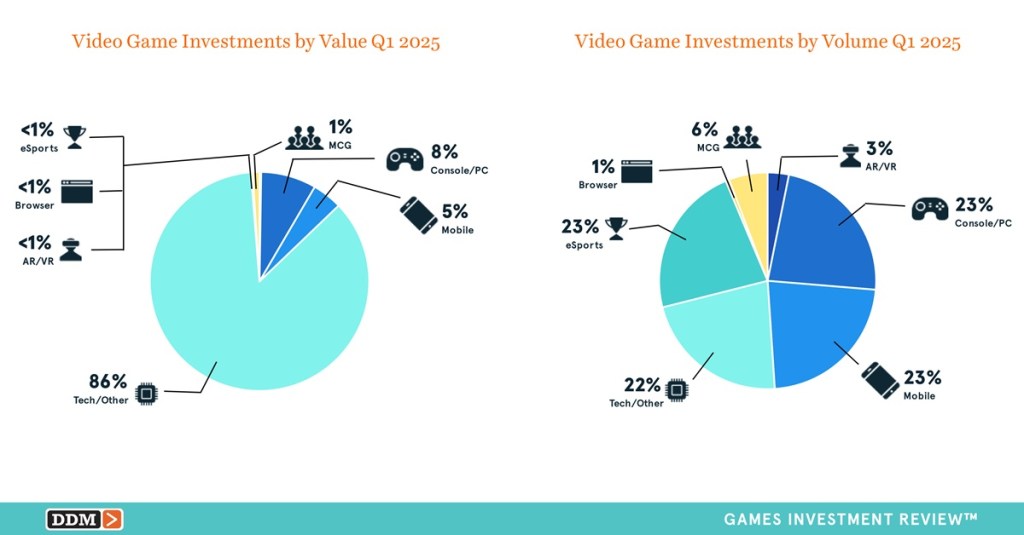

The highest value by value was directed by technology/other (86%), followed by console/PC (8%), mobile (5%), MCG* (1%), electronic sports (<1%), AR/VR (<1%) and browser (<1%).

And the unleashed investments of the first quarter of 2025 totaled 93 investments (49% of the quarter); Using historical averages to estimate unleashed investment values, the first quarter of $ 4.9 billion reached $ 4.9 billion [+/- $179.1 million].

Rifle

The quarter of the quarter totaled $ 3.3b in 55 transactions (-34% in value and +53% in volume compared to the $ 5.1b million Q4 in 36 transactions) reaching the highest quarterly volume from Q4 202 or 63 transactions; The considerable decrease in value is the result of non -revealed M & a totaled 44 transactions (80% the total volume or +13% above the quarterly average of 67%).

The Game Developer Q1 2025 totaled $ 2.1 billion in 26 transactions ( +7% in value and +53% in volume compared to the $ 2.0 billion Q4 in 17 transactions).

The highest value segment was directed by mobile (63%), followed by console/PC (36%), MCG* (1%) and eSports (<1%).

Asia, Europe and North America led M&A activity by value and volume with Asia for a total of $ 1.3 billion in seven transactions (38% of the value and 13% of the volume) and Europe for a total of $ 1.2 billion in 22 transactions); North America contributed to 38% of the total transaction volume, however, the values of agreement were not revealed.

Departures (M&A + OPI)

Q1 2025 The exits (M&A +OPO) totaled $ 5.6 billion in 56 transactions ( +10% in value and +44% in volume compared to the $ 5.1 billion of issue of issue and 39 in volume) that mark the value of the 67 largest of the quarter from the point of view of the fourth quarter they date back to Q1 2024 or $ 5.2 million.

The Inverse Spac Fusion of Grand Center is the first transaction of this type since the $ 15.9 million semper fortis fortis agreement in the fourth quarter of 2023.

The only IPO of the first quarter had a market capitalization of $ 2.2 billion (+14,038% in value and -67% in volume compared to the $ 15.9 million Q4 in market capitalization combined in 3 opi).

The highest output (M&A + opi) by segment value was directed by Tech/Other (40%), followed by mobile phones (37%), console/PC (22%), MCG* (1%) and electronic sports (<1%).

Funds

[Note: DDM tracks announcements from venture capital firms and funds on the new capital they raise that eventually become deployed in the investments in its reports].

The First Quarter’s New Fund AnnoCements TotalD $ 21.8 Billion Across 43 Funds ( +122% In Value And +13% In Volume Compart To Q4’s $ 9.8 Billion Across 38 Funds) Marking the Largest Quarter Acossese Sencements Syxecements Sydecements Sydecements Sydecements Sydecements Sydecements Syxe. Syzecements This 2.2 Times Qoq Value Growth Was Driven By Five Funds collectively raising more than $ 14.3 billion (65% of the capital collected): Bank of China ($ 6.9 billion), Khosla Ventures ($ 3.5 billion), Thoma Bravo ($ 1.9 billion), Haun Ventures ($ 1.0 billion) and the government of India ($ 1.0b).

It is worth pointing out: Not all capital will be invested in games. Artificial intelligence and block chain are still attracting a significant interest of risk capital companies, since funds aimed at the total $ 5.2 billion in 15 funds ( +128% in value and +15% in volume compared to the Q4S acroschains acroschains acroschain billion in 14 funds).

The funds that focused only on early stay companies dominated in value and volume that raise $ 10.9 billion in 28 funds (50% of the value and 65% of the volume) with agnostic funds in the stage that are close to the collection of $ 8.8 billion in 13 funds (40% of the value and 30% of the volume); The funds focused only on the middle/late companies raised $ 2.1 billion in two funds (10% of the value and 5% of the volume)

*Mass community games (MCG) are games promoted by online community game. Includes Mamos, Mobas, Battle Royale and Metverse Games.

Methodology

In the values of the reports, DDM only includes agreements when investment or acquisition closes, not simply announced. This methodology has been used consistently with DDM data for more than 17 years and guarantees that the company measures real activity instead of potential activity.

In addition, with SPACS, DDM considers that the value of the investment is what was collected in the transaction, not the valuation of the company later. This is consistent with the way in which DDM traces investment data, where it tracks the money raised in the transaction and, separately, its effect on the general business value of the company.

The exclusion of the announced agreements can lead to a big difference between the quarterly Total DDM and other companies, but DDM said its methodology offers a clearer image of the money deployed in the last quarters consisting of data acquisitions.